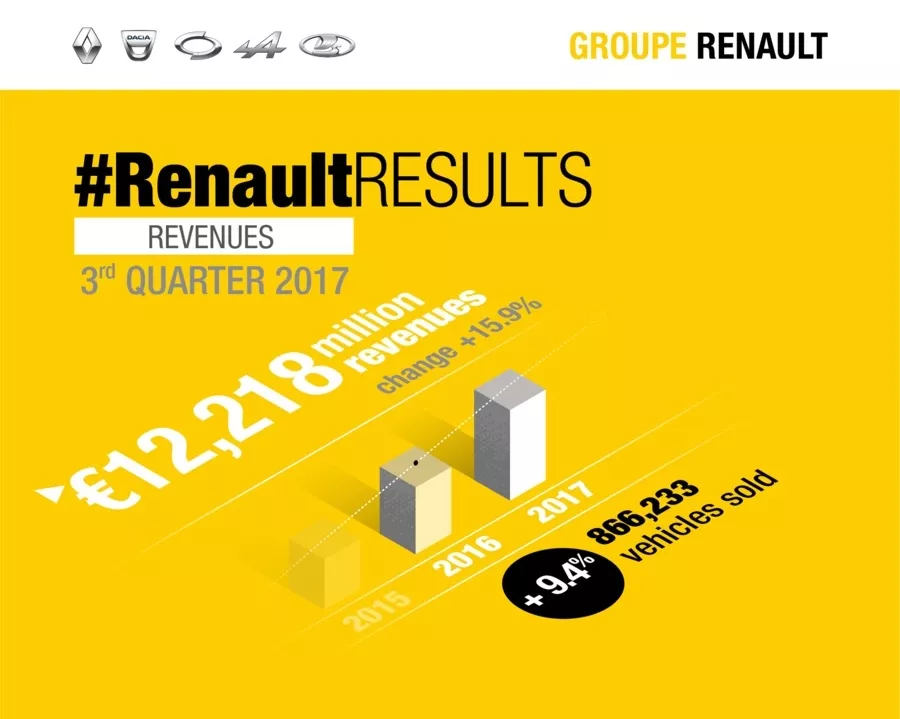

Revenues up 15.9 % in third quarter 2017

-

In third quarter 2017, Group revenues came to €12,218 million.

-

Groupe Renault sales rose 9.4% to 866,233 vehicles in a market that expanded by 3.4%.

-

In Europe, Group registrations rose 4.9% in a market that grew by 1.4%. Buoyed by the success of New Koleos, ZOE Z.E.40 and the Dacia range, the Group increased its market share by 0.3 points to 9.9%.

-

Outside Europe, Group sales expanded by 13.5% with strong momentum in the Americas (+14.0%) and in Eurasia (+24.3%).

-

The Group is confirming its guidance for the year.

In third quarter 2017, Group revenues came to €12,218 million.

Groupe Renault sales rose 9.4% to 866,233 vehicles in a market that expanded by 3.4%.

In Europe, Group registrations rose 4.9% in a market that grew by 1.4%. Buoyed by the success of New Koleos, ZOE Z.E.40 and the Dacia range, the Group increased its market share by 0.3 points to 9.9%.

Outside Europe, Group sales expanded by 13.5% with strong momentum in the Americas (+14.0%) and in Eurasia (+24.3%).

The Group is confirming its guidance for the year.

24 October 2017 17:45

Boulogne-Billancourt, October 24, 2017 – Groupe Renault revenues came to €12,218 million in the third quarter of 2017 (up 15.9%). Excluding the impact of the consolidation of AVTOVAZ, Group revenues increased by 9.8% to €11,584 million (up 12.2% at constant exchange rates).

During this quarter, Groupe Renault continued to report rising sales (+9.4% to 866,233 units) and market share (+0.2 points to 3.8%) at global level .

In Europe , Group registrations rose 4.9% in a market that grew by 1.4 %, with 397,097 vehicles registered in the third quarter. The Group took a 9.9% share of the European market, up 0.3 points.

The Renault brand posted growth of 2.9%, buoyed by the launch of New Koleos and the success of ZOE Z.E. 40. Clio is Europe's second best-selling vehicle, while Captur is the number-one crossover in its segment.

Renault continues to lead the way in the electric vehicle segment, with 7,697 vehicles sold in the third quarter. ZOE registered 6,665 sales, an increase of 67%.

The Dacia brand reported a 10.3% rise in sales, driven primarily by the performance of Sandero (+12%).

Outside Europe , the Group is continuing to consolidate its position with the success of new models: sales rose 13.5% in a market that expanded by 5.5%.

In Eurasia , sales rose 24.3 % in a market that grew by 15.5%. The market share of the Group, which now includes the Lada brand, increased by 1.8 points to 24.6%.

In Russia , the Group's second biggest market in volume, sales jumped 22.9% (at constant scope, including Lada). Buoyed by the success of Lada Vesta, Lada Xray and Renault Kaptur, the Group increased market share to 28.2%, a rise of 1.2 points.

In Turkey , sales surged by 40.6%. The Group increased market share by 3.5 points to 18.8% on the back of the success of New Mégane Sedan, which totalled over 8,412 registrations in the third quarter.

In Asia-Pacific , Group registrations rose 21.1% in a market that grew by 4.7%. In China , the Group increased sales by 123.6%, with 16,807 vehicles sold during this quarter. In South Korea , Renault Samsung Motors sales fell by 8.2% owing to the lack of new model in a fiercely competitive market. This fall follows strong growth in 2016 with the launch of SM6 and QM6.

In the Americas region, sales rose 14.0% in a market that expanded by 7.1%. The Group increased its market share by 0.4 points to 7.3%. The Group is continuing to reap the full benefits of the recovery of the Brazilian market, which expanded by 14.6%. Registrations jumped 24.8% and market share rose to 8.5% (+0,7 points), buoyed by strong sales of the new models, Captur and Kwid. Launched in July, Kwid has already totalled over 13,600 sales.

In Argentina , where the market expanded by 18.5%, Group registrations rose 7.7% pending the Kwid start of sales.

In the Africa, Middle-East, India region, Group registrations fell by 1.3% in a market that grew by 4.2%. In India, sales fell by 20.7% on third-quarter 2016, pending the launch of Captur in early November.

In Iran , the Group confirmed the trend noted in first-half 2017 with a 28.1% increase in deliveries, on the back of the success of Tondar and Sandero. The Group increased its market share by 0.8 points to 10.5%.

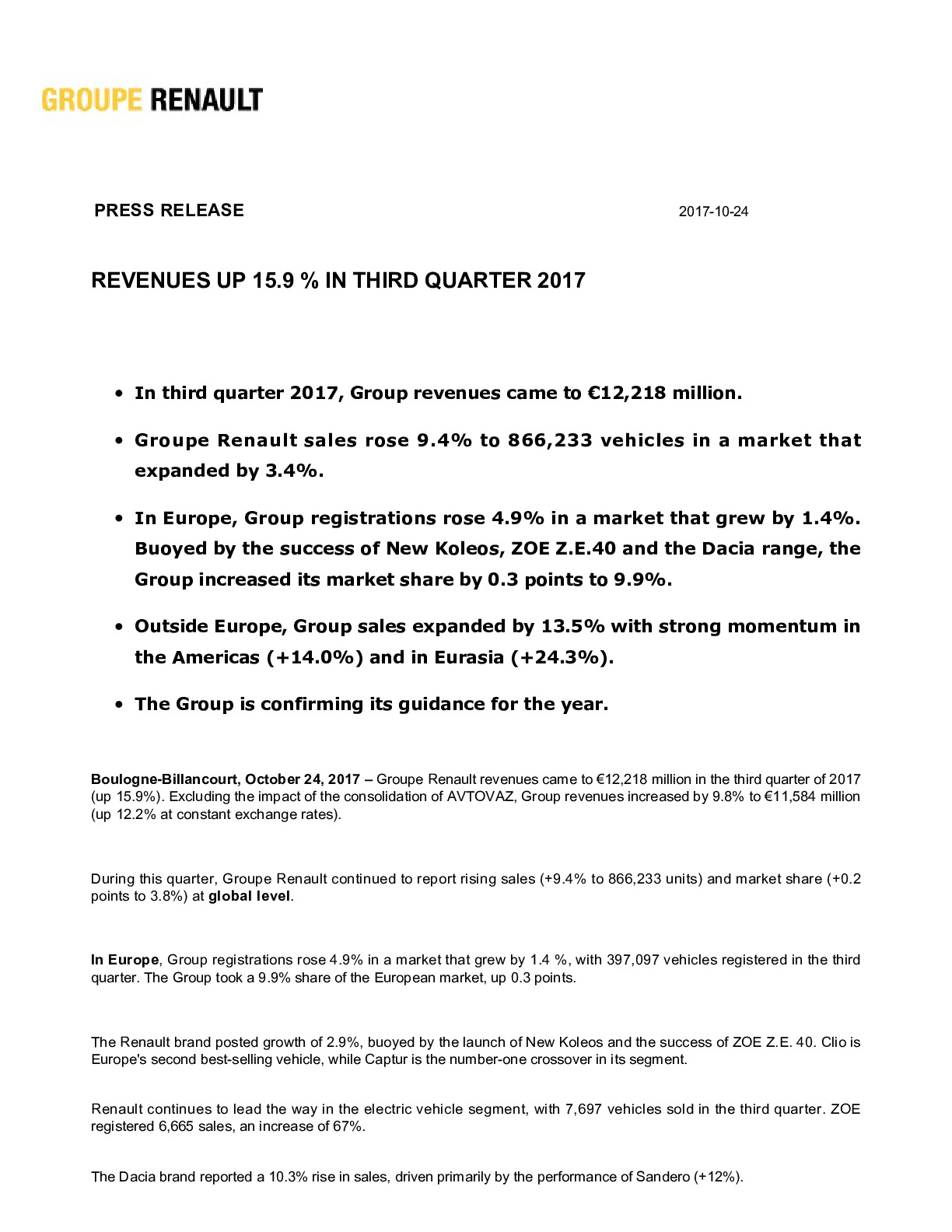

Third quarter revenues by operating sector

Automotive excluding AVTOVAZ revenues totaled €10,974 million (up 9.9%). The volume effect (+2.7 points) is still benefiting from the on-going recovery in the Russian, Brazilian and Turkish markets, as well as the good sales momentum in Europe. The combined effect of price and mix is impacting positively for 2.2 points. The increase in sales to partners contributed 4.8 points to the revenue growth, reflecting the positive momentum in sales of vehicles assembled (notably in Europe with the ramp-up of Nissan Micra production) and in our CKD 1 activity in Iran and China. The “others” effect (+2.6 points) is mainly explained by the robust performance of used vehicles and spare parts activities. The currency effect turned negative at -2.4 points, mainly due to the strengthening of the Euro versus a basket of currencies (notably Argentinean peso, Turkish lira and Korean won).

Sales Financing (RCI Banque) posted revenues of €610 million in the third quarter, up 9.5% on 2016. The number of new financing contracts increased by 14.0%. Average performing assets rose 18.2% to €40.1 billion.

AVTOVAZ revenues amounted to €634 million in the third quarter (entity not fully consolidated in 2016).

1 CKD: Complete Knock Down.

Outlook for 2017

In 2017, the global market should see growth of 2% to 3% (versus +1.5% to +2.5% previously). The European market is expected to grow around 3% (versus +2% previously). The French market is expected to expand by around 4% (versus +2% previously).

Outside Europe, the Russian market could grow around 10% (versus more than 5% previously), and the Brazilian market up to 8% (versus by 5% previously). The growth momentum is expected to continue in China (around 5%) and India (more than 8%).

Within this context, and including AVTOVAZ, Groupe Renault is confirming its guidance:

- increase Group revenues, beyond the impact of AVTOVAZ (at constant exchange rates)*,

- increase Group operating profit in euros*,

- generate a positive automotive operational free cash flow.

* compared with 2016 Groupe Renault published results

Groupe Renault consolidated revenues

|

(€ million) |

2017 |

2016 |

Change 2017/2016 |

|

Q1 |

|

|

|

|

Automotive excl. AVTOVAZ |

11,939 |

9,942 |

+20.1% |

|

Sales Financing |

621 |

547 |

+13.5% |

|

AVTOVAZ |

569 |

- |

- |

|

Total |

13,129 |

10,489 |

+25.2% |

|

Q2 |

|

|

|

|

Automotive excl. AVTOVAZ |

15,056 |

14,136 |

+6.5% |

|

Sales Financing |

630 |

560 |

+12.5% |

|

AVTOVAZ |

722 |

- |

- |

|

Total |

16,408 |

14,696 |

+11.6% |

|

Q3 |

|

|

|

|

Automotive excl. AVTOVAZ |

10,974 |

9,989 |

+9.9% |

|

Sales Financing |

610 |

557 |

+9.5% |

|

AVTOVAZ |

634 |

- |

- |

|

Total |

12,218 |

10,546 |

+15.9% |

|

9 months |

|

|

|

|

Automotive excl. AVTOVAZ |

37,969 |

34,067 |

+11.5% |

|

Sales Financing |

1,861 |

1,664 |

+11.8% |

|

AVTOVAZ |

1,925 |

- |

- |

|

Total |

41,755 |

35,731 |

+16.9% |

About Groupe Renault

Groupe Renault has been making cars since 1898. Today it is an international multi-brand group, selling close to 3.5 million vehicles in 127 countries in 2016, with 36 manufacturing sites, 12,700 points of sales and employing more than 120,000 people. To meet the major technological challenges of the future and continue its strategy of profitable growth, the Group is harnessing its international growth and the complementary fit of its five brands, Renault, Dacia and Renault Samsung Motors, Alpine and LADA, together with electric vehicles and the unique Alliance with Nissan and Mitsubishi. With a new team in Formula 1 and a strong commitment to Formula E, Renault sees motorsport as a vector of innovation and brand awareness.

Sur le même sujet