World sales results, first-half 2011

11 July 2011 08:00

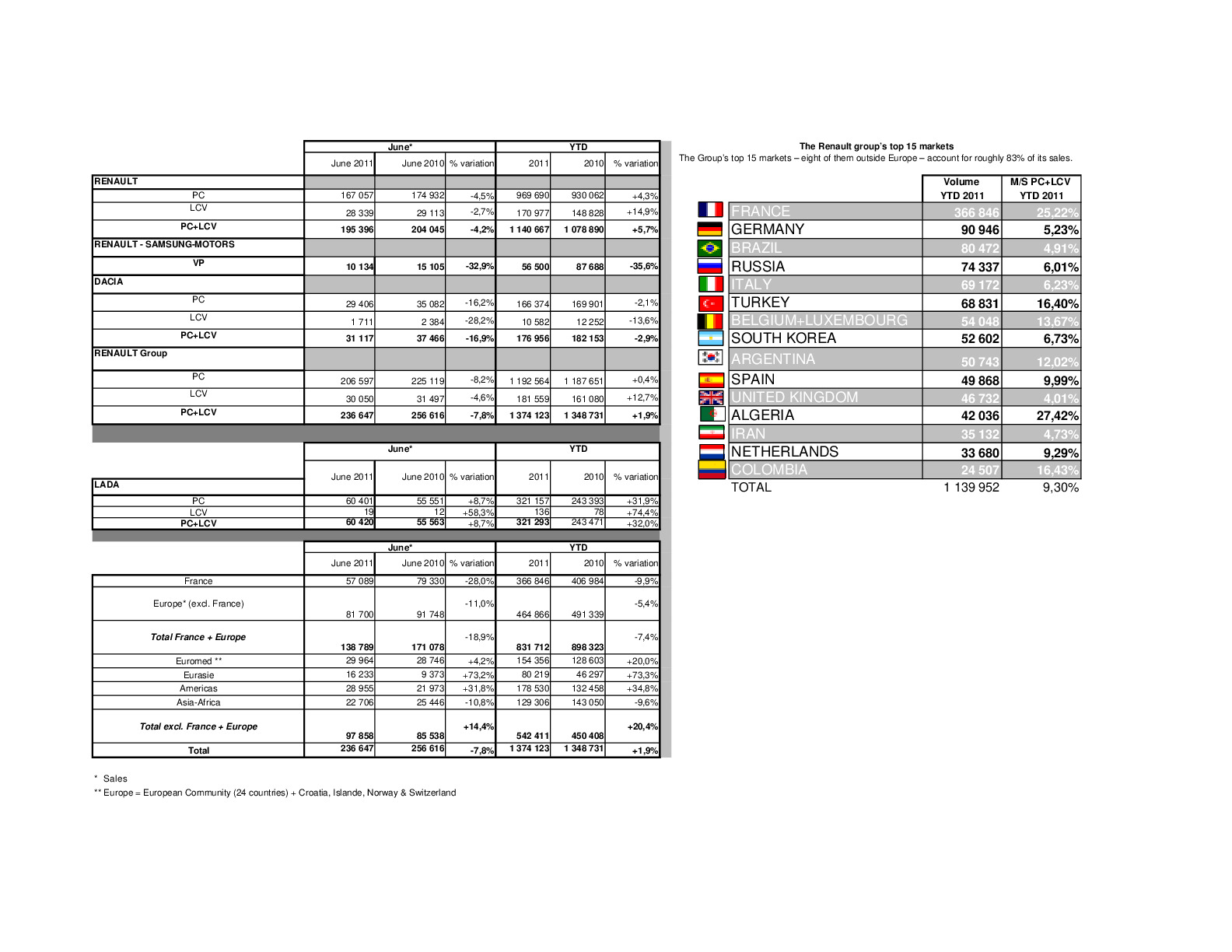

The Renault group set a new sales record worldwide in first-half 2011 with 1.4 million units, up 1.9% on 2010.

Sales were driven by international business, up 20.4% year on year, and by the Renault brand, up 5.7%.

Renault group highlights in first-half 2011

- International: the Group confirmed both its growth potential and globalization with sales of 542,000 vehicles, up 20.4% on first-half 2010. The share of Renault group vehicles sold outside Europe grew by 6 points and now accounts for 40% of total sales.

- Europe: the Renault brand maintained its position as the number-two brand in passenger cars (PC) and light commercial vehicles (LCV) with a market share of 8.5%. It also retained its LCV leadership with a market share of 15.2%.

- France: Renault remained the leading brand in PC + LCV sales. But Renault group PC sales contracted owing to the combined effect of low stock levels and supply constraints in a market that exceeded our forecasts.

- The Renault brand, which grew 5.7% worldwide (present in 112 countries) and sold 1.1 million vehicles, accounted for 83% of the Group’s total sales volume. The Dacia brand, sold exclusively in Europe and the Euromed Region, reported a 3% decrease in sales (177,000 units) and the Renault Samsung Motors brand, focused on South Korea, saw its sales fall 36% to 56,000.

Commenting, Jérôme Stoll, Executive Vice President, Sales and Marketing and Light Commercial Vehicles, said: “ Despite mixed results in Europe, the Group continued to grow sales, setting a record for first-half sales. This performance was based as expected on strong international growth, with an increase of more than 20%, thanks notably to two key countries for the Group, Brazil and Russia ”.

World

In PCs, the Renault group reported a 0.4% increase in sales volumes with 1,192,564 vehicles, for a market share of 4.3%.

In LCVs, Renault group sales came to 181,559, up 12.7% on 2010.

Europe Region (including France)

-

PC + LCV: with 831,712 vehicles sold and market share of 10.1%, the Renault group saw its PC + LCV sales fall 7.4%, for a 0.7 point decrease in market share, mainly due to supply constraints. For the first six months of the year, lost sales are estimated at roughly 50,000 cars in Europe.

-

PC: Renault group sales fell 9.6% for a market share of 9.4%, down 0.8 points. Renault brand sales in Europe were driven mainly by Twingo, Clio and the Mégane family.

-

Twingo ranks number three in Europe, with a 10.8% share of its segment. The Twingo Miss Sixty and Twingo Gordini limited edition models posted very good performances.

-

Clio 2 and 3 sales totaled 164,000 units.

-

With 215,000 units in the C segment, the Mégane family ranked second with a 7.9% share of the segment, notably thanks to Scénic, which remains the leader in the minivan category.

-

With a supply constraint on diesel engines, the Dacia brand reported a 2.5% decrease in sales and maintained a market share of 1.6%. Dacia Duster, launched in April 2010, has proved extremely successful, with nearly 71,000 registrations at end-June.

-

LCV: the Renault brand remains the LCV leader in Europe (since 1998) with a 7% increase in sales and a 15.2% share of the market (up 0.2 points). These results were based on the success of Master, launched in April 2010, which has increased its share of the segment by nearly 4 points in the last three years, and also on the success of Trafic and Kangoo.

France:

The Group reported a 9.9% fall in sales with market share down 3.3 points to 25.2%. With both the market and ordertake exceeding our forecasts, combined with low stock levels at end-2010, the Group was unable to deliver and register a sufficient number of vehicles. Thus registrations do not reflect the positive sales dynamic. In fact, the order book is 18% larger than at end-June 2010 and represents two months of sales.

In this context, the Renault brand nevertheless consolidated its number-one position in PC sales to private and corporate customers as well as in LCV sales, with a 30.6% share of the market. Twingo, Clio and Mégane remained the leaders in the A, B and C segments year-to-date through end-June.

The Dacia brand, ranked fifth in sales to private customers with 50,417 units and reported a 21.6% fall in sales for market share of 3.5%. The good performance of Duster (10 th best-selling model in France and second in the 4x4/crossover segment) did not offset the decrease in registrations for Sandero, linked to the end of the LPG bonus. The Dacia brand was also affected by supply constraints.

Regions outside Europe

International PC + LCV sales increased 20.4% on first-half 2010 and now account for 39.5% of Renault group sales, compared with 33.4% at end-June 2010. Sales of Renault brand light commercial vehicles grew strongly internationally, notably in the Euromed Region (9.9% market share, up 2.6 points) and the Americas (2.8%, up 0.6 points).

The Americas, Euromed and Eurasia Regions set sales records:

- Americas: with 178,530 units sold and a 5.7% share of the market (up 0.8 points), the Renault brand set a new sales and market-share record. The launch of Renault Sandero phase 2, a model developed exclusively for the Americas Region, will allow us to further improve our sales performance.

Brazil confirmed its place as the Group’s number-three market (up three places on 2010) behind France and Germany, and reported a 24.6% increase in sales volumes with a 4.9% share of the market. Renault is the fifth ranked brand in Brazil. - Euromed: with sales rising 20% to 154,356 units, the Group’s Renault and Dacia brands set a PC + LCV sales record. Renault Symbol leads its segment in the region.

In Turkey, the Group surpassed its sales record with registrations up 69% to 68,831 (Renault and Dacia brands). Renault Symbol is the best-selling vehicle all categories combined with 18,600 units sold – an increase of 71%. Renault Fluence is number one in its segment with 14,700 units sold and Renault Latitude has been very well received. - Eurasia: with a 73.3% increase in sales to 80,219 units, the Group reported record sales and market share (5.7%) mainly thanks to Russia, where sales rose 76% for market share of 6%. Renault became the number-three brand, moving up one spot on 2010. Renault Logan is the best-selling foreign-make car and the fifth best-selling car all categories combined.

- Asia/Africa: with 129,306 units, the Renault group reported a 9.6% fall in sales, with contrasted results.

The Group posted a very good performance in Iran thanks to Logan and Mégane, with sales up 70% and a 4.7% share of the market. Results were down in South Korea for the Renault Samsung Motors brand, stemming mainly from the end of life of SM7, supply difficulties linked to the tsunami in Japan and strong pressure from competitors.

In India, one of the Group’s three priority markets internationally, after the launch of Renault Fluence in May 2001, the Renault brand will launch Renault Koleos in second-half 2011 and Renault Duster in 2012. In all, five vehicles will be launched between now and end-2012.

Product launches in first-half 2011

-

Energy dCi 130 engine (115 g/km of CO 2 ) on Scénic and Grand Scénic in Europe

-

Renault Sandero Stepway in Russia, South Africa and the Maghreb countries (Algeria, Morocco).

-

Renault Sandero phase 2 in South America

-

Renault Fluence in Brazil, Colombia, India and China

-

Renault Mégane CC in Euromed

-

Renault Scénic and Grand Scénic in China

-

Renault Latitude in Europe, Turkey, the Americas and China

-

Renault Master in Russia, Ukraine and Israel

Commercial outlook for second-half 2011

The second half of the year will see divergent trends between Europe and the rest of the world. The Group is forecasting 3% to 4% growth in the global market in 2011 compared with 2010, despite an estimated 0% to 2% decline in the European market and a 4% to 6% fall in the French market year on year.

The supply difficulties that have mainly affected Europe are expected to be gradually reduced starting in July. The Group’s production sites will return to a high level of activity from end-August, and our delivery times will become shorter. In France, the Group’s market share at end-2011 should be close to that of end-2010.

Jérôme Stoll commented: “ Thanks to the strong order portfolio in Europe and the pursuit of our international sales offensive, the Renault group is forecasting a new sales record for the year as a whole. In Europe, the second half of the year will be marked by the launch of the first three vehicles in Renault’s electric range, Kangoo Z.E., Fluence Z.E., and Twizy .”

Sur le même sujet